|

| |

CitiBank,

World’s largest financial institution.

After the merger with Travelers Insurance, the Chicago office was out of balance

in their cash accounts by $22 billion. The Chicago office handles all of

the cash transactions for Illinois, California, Florida, Massachusetts, and Washingon D.C. This situation affected the cash transactions between

Citibank and the major financial institutions like: Harris Bank, LaSalle

Bank, Northern Trust, Wells Fargo, and the Federal Reserve Banks.

We developed and implemented a new Cash Reconciliation System that has enabled over

180 accountants to reconcile

cash

and related accounts on a daily basis. It

has facilitated the investigation of outstanding

items resulting in the reduction of the contingent liability from $22 billion to

$25 million. This success has given stability to over 240 department employees.

|

|

|

|

|

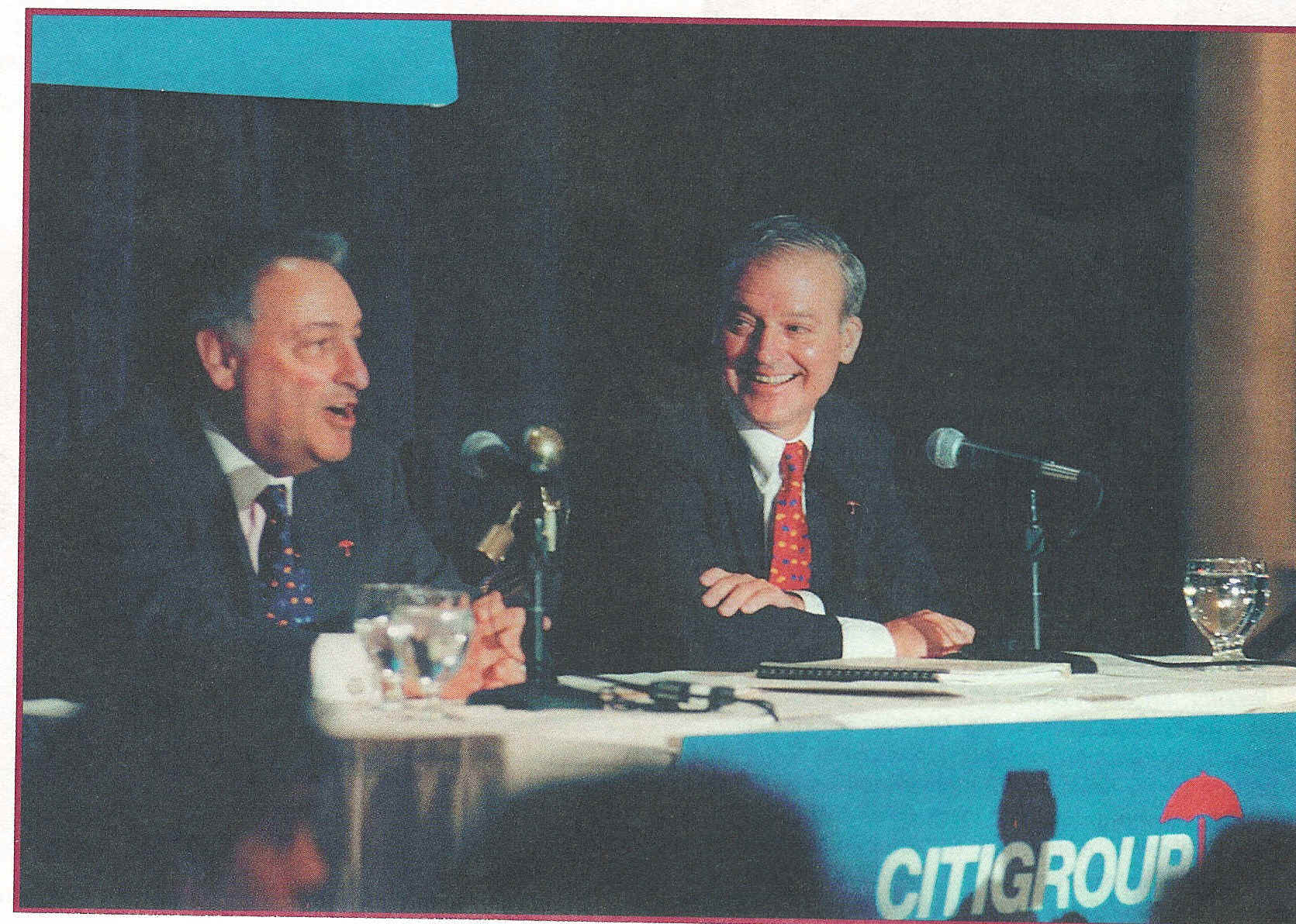

Sandy Weil & John Reed - Co Chairs of CitiGroup |

Citibank - Madison Street, Chicago |

|

Cash Management

|

Access & Visual Basic

|

| CitiGroup, $700 billion financial services group.

Crisis & Challenge: After the merger of Citibank and Travelor's Insurance,

the Chicago office of Citibank was out of balance in their major cash

accounts by $22 billion with other financial institutions like: Harris Bank,

Northern Trust, LaSalle Bank, and the Federal Reserve banks.

The

Chicago office managed the cash accounts for Illinois, California,

Florida, Massachusetts, and Washington D.C.

The out of balance

condition created a contingent liability of over $22 billion. This

was a crisis situation.CitiGroup brought in five KPMG Sr. Managers

and fifteen KPMG staff accountants to help oversee the reconciliation of

the cash accounts. They also brought in three Sr. Executive

officers from CitiGroup in St. Louis to oversee the process.

| Designed, Programmed and implemented new Cash Reconciliation

database system for the Cash Reconciliation Group. |

| Designed and programmed new Cash Reconciliation database using

Access and Visual Basic programming. |

| Managed four IT consultants in development of Cash

Reconciliation database. |

| Trained over 275 cash reconcilers, Citibank management, and KPMG

staff on new Cash Reconciliation system.

|

| Cash Reconciliation system enabled over 180 accountants

to reconcile

their cash accounts on a daily basis.

|

| Facilitated the

investigation of items outstanding items |

| Resulted in the reduction of contingent

liabilities from $22

billion to $25 million. |

| Brought job stability to over 240 Citibank employees. |

These systems have been developed using Microsoft Excel,

Access, MS Project, and Visual Basic. Extensive systems development has been done using Microsoft products. |

|

top

|